Apple Inc. faces taxation challenges in Ireland by the European Commission for apparent charges of not paying the required taxes a corporation is due to pay. Instead, Apple received major tax incentives in sales for their company operating in Cork, Ireland.

Apple has had an established place in Ireland’s technology world for the past 35 years, since 1980. To date, it has been one of Cork’s major employers. And since this time the tax law that was in place was followed and strictly adhered to by the Apple company. Then, in 1991 the tax law changed and the Irish authorities and Apple Inc., lead by Chief Financial Officer Luca Maestri, mutually agreed to follow this new tax law. This agreement was set to begin in 1991 and continue through 2007.

However, like in the US, Apple’s popularity of products – particularly its iPhone – caused a huge growth in sales in Ireland. This was when Ireland decided to change its tax law as a direct. Probably a valid play on the part of Ireland. Attempting to work with the Irish authorities, Maestri stated that Apple “asked for an “advanced opinion” to deliver “complete certainty” about the company’s tax liabilities.” This change came on the heels of Apple investing $100 million into its operations in Ireland for its products. This change was a bit of a surprise for Apple.

Anyone on the outside looking in would not fault Apple and Maestri for trying to do the right thing in this situation and ensure that Apple was paying their fair share in corporate taxes to the Irish authorities. He wanted to do the responsible thing. Therefore, Apple wanted to work out the tax agreement with Ireland by trying to find out exactly how much had to be paid to Ireland. In an interview with Financial Times, Maestri said,

“If countries change the tax laws, we will abide by the new laws and we will pay taxes according to those laws.”

It was later found out that Ireland had changed their tax laws close to ten times since 2007. And Apple has adhered to their laws every day. Now that the Irish authorities are seeking back taxes from Apple, who are still willing to work with them, as long as it’s a fair fight.

So, when Apple received what was called “tax incentives” dating back to when the company was first established in Ireland, it began to raise the eyebrows of other countries as well. It’s now been seven years since the last agreement between Apple and Ireland, and the OECD (Organization for Economic Cooperation and Development) is making headlines by pursuing permanent policies between Europe and America that would stop countries from offering any kind of tax benefits (rewards) to companies. Ireland is not the only country that has offered these tax benefits in the past. Namely, Luxembourg and the Netherlands have also offered them.

The OECD cannot strong arm Ireland, or any other country, to adhere to these new policies. So, they involved the assistance of the European Commission to charge any country with large companies like Apple offering them tax incentives, with a forced “state aid” that they must pay. This state aid is an anti-competitive tax put on companies like Apple that have businesses in countries with low taxes.

Now the European Commission would be charging these companies this new imposed tax simply because it believed that the company was getting undocumented and unfair tax advantages solely because they are large companies. In the long run, this hurt other businesses that would competition for these already established companies. (It also turns out that Apple is not the only company getting hit with this new tax policy. Other companies like Starbucks in Luxembourg is also getting hit.)

Apple seems to be a direct target of the European Commission because the company is so large and so popular. The notoriety of the Apple iPhone has caused other competitors like Nokia in Ireland to weaken and essentially crumble. In fact, Microsoft had to step in and acquire Nokia in Ireland from its financial group. However, this still resulted in the loss of numerous jobs for Irish workers. This seems like a personal vendetta of the European Commission against Apple. The truth is, neither Apple nor Ireland committed anything illegal with their original tax agreement years ago. Maestri was quoted as saying,

“There’s never been any special deal, there’s never been anything that would be construed as state aid.”

When compared to their counterparts, Apple pays a lot more in taxes for their company. Therefore, Apple is not going down with a strong fight. They claim that the European Commission to impose payment of unpaid back taxes, or taxes that should have been paid but weren’t because Apple received some kind of special deal, hold no weight and are completely invalid. The policies of anti-competitive state aid to be paid by companies has actually not been adopted by Ireland, therefore Apple argues that they should not be made to pay it. In addition, with the large amount of taxes Apple already pays for its company in Ireland, the European Commission should be satisfied with that.

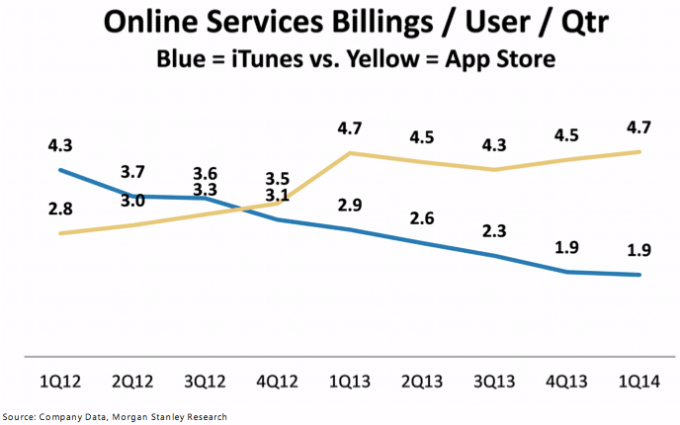

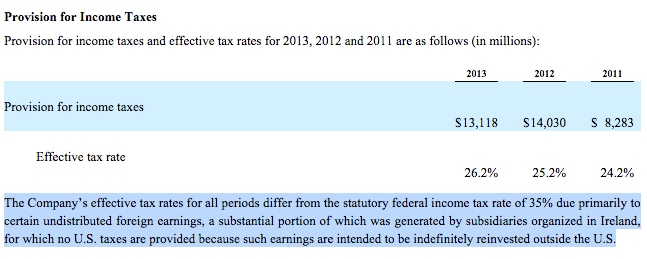

According to a recent testimony before the US Senate, Tim Cook, Apple’s CEO, stated that the company paid $6 billion in federal taxes for that previous year. This amount was the largest paid by any American corporation. In 2013, Apple’s tax rate was 26.2 percent. Its counterpart, Microsoft, reports paying a much lower rate of 19 percent for their European companies in places like Ireland and Singapore.

Tim Cook used his time before the US Senate to also address the current tax laws to enable major companies like Apple to use its foreign earnings domestically. He mentioned South Korea’s tax rates of 20 percent and recommended that the US do the same. According to Cook,

“The tax code has not kept up with the digital age.”

The current tax policy prevents companies like Apple from spending their foreign earnings in the US because of the 35 percent tax rates.

The tax policies of OECD have not been embraced South Korea, and because of this, they can provide very low tax rates for companies like Samsung, who current tax rates are 12-16 percent. However, even though South Korea may be a good example of low tax rates that will benefit large companies, they are also not exempt from shady dealings, particularly with Samsung’s chairman. According to the NY Times, the South Korean government “pardoned the company’s chairman of multimillion embezzlement and tax evasion convictions so that he could both avoid prison and retain his membership at the International Olympic Committee.” Subsequently, this controversy, even with the seemingly large benefits of low tax rates, has hurt Samsung’s profits.

Since the European Commission is pushing their tax policy, and seemingly attempting to target Apple for more money, it implies that Apple because wealthy and successful in Ireland with the help of the Irish taxpayer. This is overwhelmingly not true. However, if the European Commission is successful in pushing their policy through and demanding state aid from Ireland and Apple, it could result in a huge rollout.