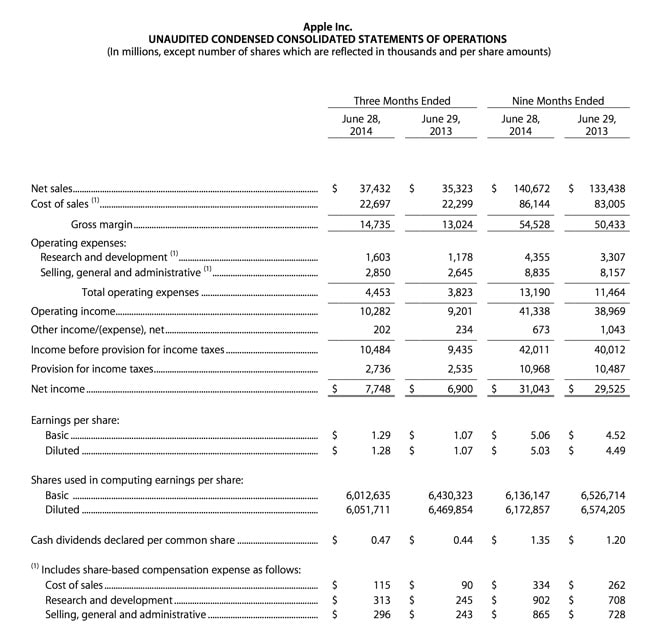

With Apple recently releasing their Q3 results, we as consumers get to sit back and gaze at their new staggering financial numbers, including a record $37.4 billion in total revenue. Gaining $7.7 billion in profit over the quarter, one can see why they have stock piles of cash on reserve, estimated to be somewhere around $150 billion. What can we tell from the numbers and see through the blanket marketing statements from the company? In a nut shell, iPhone sales are booming and iPad sales are dragging.

The good thing about Tim Cook and Apple in general is that they quickly, although at first quietly, address issues. Evaluating the iPad’s future can be difficult after all technology changes so fast. We know this much, that the iPad has more upside then downside. Look at the business market, dominated by Microsoft for decades, Apple is ready to bounce where they see opportunity. Recently announcing a landmark deal with IBM to bring corporate data and mobile devices together better than ever before, Apple is showing a willingness to explore partnerships that make sense. To be honest with that kind of cash reserve who can blame them. They are a lot better off then some of their closest competitors. With Microsoft laying off 18,000 workers it’s clear to see Apple is dominating, staying fiscally lean and technologically innovative.

With OS X Yosemite and iOS 8 coming out in the fall, Apple is looking to integrate both operating systems into a seamless experience for their users. Every product launch Apple checks another item off our wish list. Add rumors of the iPhone 6 and iWatch into the mix and consumers are always hungry for the latest from Apple. Of course there is always room for debate, enter the standard who’s copying who topics that spring up during new releases. In the end they deliver.

Who benefits from Apple’s robust business and financial tactics? Well the easy answer are the Apple fanatics around the world who rejoice when using their great products. But the real answer are the Apple shareholders who gained a cool $1.28 per share stemming from the billions in quarterly profit. Throw in a cash dividend of $.47 per share this August and a stock yield of just under 2% you are looking at some happy investors. Their recent stock split has others asking if now is the time to buy.

If you missed Apples’s fiscal results conference call you can catch it here, though it’s usually taken down in 2 weeks. Tim Cook provides some additional insights to next quarter and answers some tough questions.